Global Trust System (GTS) – Digital Work & Payment Trust Layer

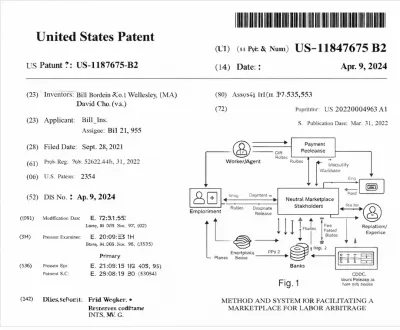

Global Trust System (GTS) is a US-patented “trust and settlement” engine for digital work and payments.

It creates a shared record that links people, the work they agree to do, the rules of that agreement, and the payments that should follow. When the agreed work is verified as complete, the system can automatically release payment through existing rails such as bank transfers, digital wallets, or future CBDCs.

Instead of relying on emails, spreadsheets, and manual checks, GTS turns each job or task into a structured digital record with clear conditions and an auditable history. This reduces disputes, fraud, and administration costs for governments, companies, and platforms that pay people for work—especially in online, cross-border, or program-funded arrangements.

Today, there is a big gap between work that is done and the payments that are made for that work.

For most digital and cross-border work, the process looks like this:

- People agree on tasks and prices by email or chat.

- Rules and conditions are buried in PDFs or contracts that computers cannot easily check.

- Payment systems (banks, cards, wallets) only see a payment request; they do not “know” what work was done or whether the rules were followed.

Because of this separation, several problems appear:

- It is hard to prove who did what work and when.

- Disputes and fraud are common, especially online and across borders.

- Governments struggle to control how public funds for jobs, training, or benefits are actually used.

- Workers cannot carry a reliable, portable record of their work history and reputation from one program or platform to another.

- New tools like CBDCs or digital wallets still sit on top of the same old trust problem: they move money faster, but they don’t solve “was the work really done under the right rules?”

In short, there is no neutral, programmable “trust layer” that ties work, rules, and payments together in a verifiable way. That is the problem this invention addresses.

Global Trust System (GTS) solves this by creating a unified digital layer that connects people, work, rules, and payments in one structured system.

The invention does three main things:

- Registers participants and roles

- Workers, employers, agencies, and platforms are registered in the system with clear roles. Their activities and outcomes build a trusted history over time.

- Turns each job or obligation into a digital “work record” with rules attached

- A task, contract, or program requirement is represented as a structured digital object. This record includes what must be done, by whom, by when, what quality is required, and how completion will be confirmed. Multiple parties can sign or approve these terms.

- Links this work record to conditional payment instructions

- Payments are not sent blindly. Instead, they are set up in advance with conditions:

- when the system records that the work record’s rules have been satisfied (for example, both sides confirm completion, or required documents are uploaded), the payment can be automatically released, split, or withheld. If there is a dispute, the system supports rework steps, arbitration, and final resolution, all logged for future audits.

This architecture can sit on top of existing rails—bank transfers, cards, digital wallets—or future CBDCs. It does not replace payment systems; it adds an intelligent trust layer above them.

By doing this, GTS:

- Reduces fraud and disputes in digital and cross-border work.

- Makes government and program payments more transparent and controllable.

- Gives workers and firms a portable, verifiable work history.

- Enables new business models where payments are tightly linked to real, provable work and compliance.

That combination of structured work records, rule enforcement, and conditional settlement is the core patented solution.

Yes. The invention addresses a specific structural gap that existing payment systems, marketplaces, and blockchain/smart-contract platforms do not solve.

Before this invention, prior art generally fell into three buckets:

- Traditional payment and benefits systems – Banks, card networks, and government disbursement platforms are very good at moving money, but they do not “understand” the underlying work or obligations. They treat every transfer as a simple debit/credit. The logic about who must do what, under which rules, and when payment is deserved lives off-system in paper contracts, PDFs, policy manuals, and caseworker decisions. This creates disputes, fraud risk, and high administrative cost.

- Escrow and marketplace platforms – Online freelance and gig platforms added basic rules such as milestones, ratings, and dispute resolution. However, these systems are closed silos: each platform uses its own internal data structures, cannot be easily reused by other programs or agencies, and does not create a portable trust history that follows the worker or employer across different environments. They also do not provide a general, standardized way for governments or enterprises to encode complex multi-party rules and public-program conditions.

- Blockchains and smart contracts – Public and private blockchains introduced programmable value transfer, but they operate at the ledger level. Generic smart-contract platforms provide tools, not a domain-specific architecture for labor and programmatic work. Most implementations still require custom coding for each project, and they do not offer a ready-made model of participants, work tokens, roles, compliance checks, and dispute flows that can be consistently applied across institutions. In practice, this means that the “trust layer” between work and payments is re-invented in every project, if it is modeled at all.

The gap, therefore, was the absence of a neutral, reusable trust and settlement architecture that:

- Represents work and obligations as structured, shared digital objects rather than ad-hoc records;

- Attaches human-readable program rules and machine-enforceable conditions directly to those objects;

- Connects those objects to conditional settlement flows on top of any payment rails (including, but not limited to, CBDCs or digital currencies); and

- Maintains a cross-platform, cross-program trust history for participants that can be audited and reused.

Global Trust System (GTS) fills this gap by defining a specific multi-layer architecture (identity/trust, work tokenization with rules, and settlement) and the methods for their interaction. It does not merely move money, and it does not merely provide a generic smart-contract toolkit. It creates a standardized way to bind who did what work, under which rules, and with what verified outcome to the actual release of funds, in a form that can be implemented across many programs, platforms, and jurisdictions.

The Global Trust System (GTS), is unique because it defines both a system architecture and a process that tightly connect people, work, rules, and payments in one programmable trust layer.

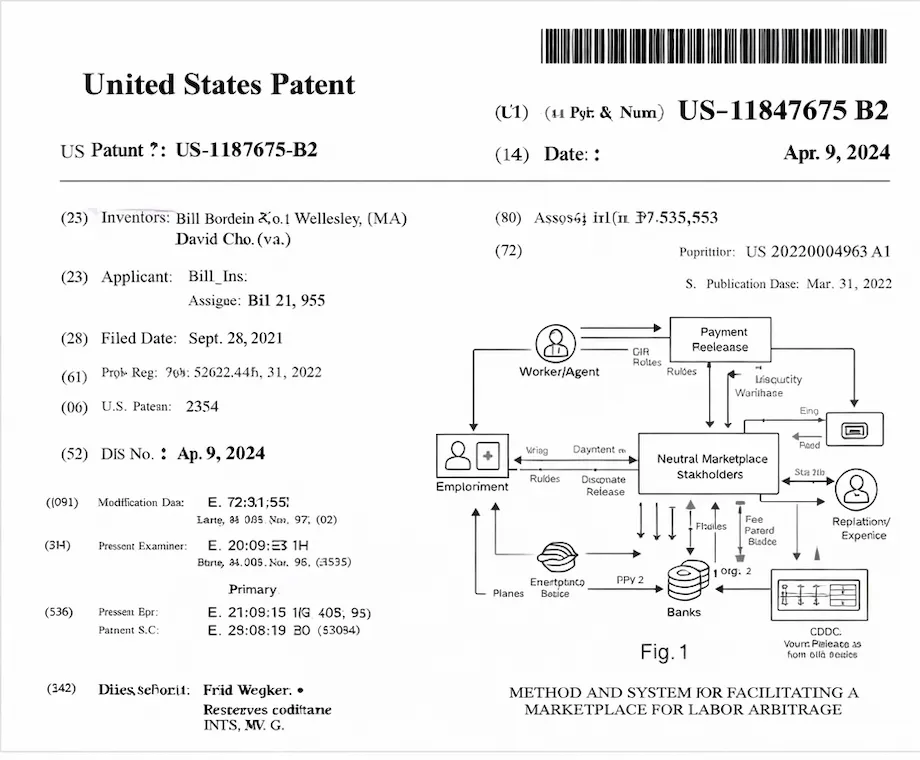

Unlike ordinary payment systems (which only see a transfer of money) or generic blockchains (which provide tools but no domain model), GTS introduces a specific multi-layer design:

• An identity and trust layer that records workers, employers, agencies, and platforms, and builds a reusable history of their performance and disputes.

• A work tokenization layer that turns each job, milestone, contract, or program obligation into a structured digital “work record” with its own attached rules, eligibility conditions, and quality checks.

• A settlement layer that links these work records to conditional payments on any rails (bank transfer, card, wallet, stablecoin, CBDC). Payments are automatically released, split, delayed, or cancelled based on the verified state of the work record and any arbitration outcomes.

This combination creates a portable, cross-platform trust record and supports complex multi-party flows (worker–employer–agency–platform–arbiter) without locking anyone into a single proprietary marketplace. It reduces fraud and disputes, enables verifiable public-program spending, and allows new business models where all parties can rely on a shared, cryptographically anchored view of “who did what, under which rules, and what they should be paid.”

Industries where the invention can be useful?

Banking and Financial Services, Payment Processing and Merchant Acquiring, Cross-Border Payments and Remittances, Digital Wallets and Fintech Platforms, Gig Economy and Online Labor Marketplaces, Payroll and HR Technology, Government Benefits and Disbursement Systems, CBDC and Digital Currency Infrastructure, Cloud Financial Infrastructure (Banking-as-a-Service, Payments-as-a-Service), RegTech and Compliance Solutions.An estimate of the total addressable market?

The invention targets the intersection of digital payments, cross-border payments, and the gig / online labor economy. Recent research values the global digital payments market at around USD 120 billion in annual revenue in 2024, growing to over USD 500 billion by 2034. The cross-border payments market is estimated at more than USD 210 billion in 2024, with strong growth expected through 2030. In parallel, the gig economy—workers and platforms whose income depends on trustworthy work-for-pay arrangements—was already over USD 550 billion in 2024 and is forecast to more than triple by the early 2030s. Combining these segments, the total addressable economic space where a trusted work-and-settlement layer is relevant is already well above USD 800 billion today, touching trillions of dollars in transaction value each year and growing at double-digit rates.Potential Customers/End Users. Who might benefit?

Central banks and CBDC solution providers; Global and regional payment processors and card networks; Banks and transaction banks offering cross-border and treasury services; Digital wallet providers and super-apps; Gig and freelance platforms, online labor marketplaces, and BPO/outsourcing firms; Payroll, HR tech, and workforce-management platforms; Government agencies responsible for unemployment benefits, workforce programs, and digital disbursement systems; Cloud providers offering Banking-as-a-Service or Payments-as-a-Service; RegTech, compliance, and audit platforms that need verifiable work-linked payment data.Actions

Added all portfolio

| Country | Current Status | Patent Application Number | Patent Number | Applicant / Current Assignee Name | Title | Google Patent Link |

| Granted / Issued | 17/535,553 | US 11,847,675 B2 | Bill Borden Shook; David Cho | METHODS AND SYSTEMS FOR FACILITATING A MARKETPLACE FOR LABOR ARBITRAGE | Google patent link |

You may also like the following patent